Business

Co-operative Bank’s Impressive Q1 Performance Highlights Strategic Growth

The Co-operative Bank of Kenya’s recent financial results reveal a robust and commendable performance for the first quarter of 2024.

The bank’s 7.7 percent increase in profit after tax, reaching Sh6.58 billion, is not just a statistic but a testament to the bank’s strategic initiatives and resilience in a competitive banking environment.

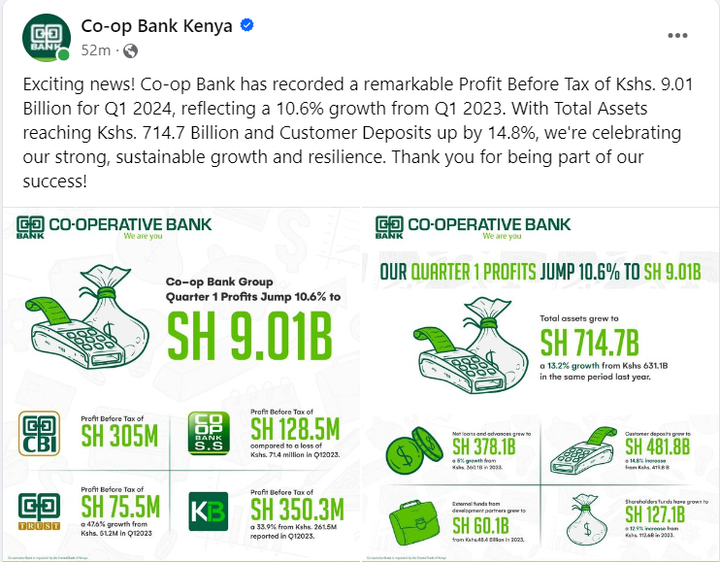

A significant driver behind this growth is the increase in net interest revenue, which rose by 8.6 percent to Sh11.7 billion.

This increase, which includes fees and commissions, suggests that Co-op Bank has been effective in expanding its core banking activities and optimizing its revenue streams. Maintaining non-interest income at Sh7.1 billion further underscores the bank’s ability to sustain its earnings from diverse sources, balancing potential volatility in interest income.

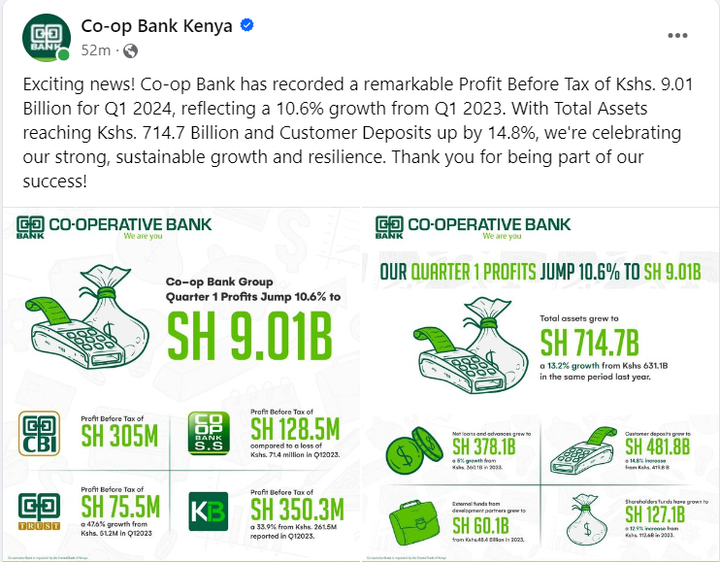

Gideon Muriuki, the bank’s Group Managing Director and CEO, has highlighted a 10.6 percent growth in profit before tax, reaching Sh9.01 billion.

This achievement, compared to Sh8.15 billion in the same quarter of 2023, is indeed commendable. It reflects not only the bank’s solid financial health but also effective cost management, given the modest 0.5 percent rise in operating expenses.

The bank’s operational efficiency is further evidenced by a 5.1 percent increase in operating income, which has outpaced the growth in expenses.

This efficiency indicates a well-managed institution capable of leveraging its resources to maximize profitability.

Moreover, the significant growth in customer deposits by 14.8 percent to Sh481.8 billion is a clear indicator of customer trust and confidence in the bank. This growth provides a strong foundation for the bank’s lending activities, evidenced by a 5 percent increase in net loans and advances to Sh378.1 billion. It demonstrates Co-op Bank’s pivotal role in supporting economic activities through credit extension.

The performance of subsidiary entities like Kingdom Bank Limited, which saw a 33.9 percent rise in gross profit to Sh350.3 million, highlights Co-op Bank’s strategic diversification. Similarly, Co-op Bancassurance Intermediary Ltd’s profit before tax of Sh305 million showcases the bank’s successful foray into the insurance sector, capitalizing on the cross-selling opportunities within its customer base.

Furthermore, the turnaround of the Co-operative Bank of South Sudan from a loss of Sh71.4 million in Q1 2023 to a profit before tax of Sh128.5 million in Q1 2024 is noteworthy. This joint venture’s performance signifies the potential for growth in regional markets despite challenging operating conditions.

In conclusion, Co-op Bank’s Q1 results reflect a well-executed strategy of growth, diversification, and efficiency.

The bank’s ability to increase profitability while managing costs and expanding its deposit and loan portfolios is a model for sustainable banking in Kenya and the region. As the bank continues to innovate and adapt, it sets a high benchmark for its peers in the financial sector.

You must be logged in to post a comment Login