Agilitee has unveiled its latest baby, the Agilitee LoadFast delivery scooter, catering to the growing demand for eco-friendly transportation solutions. This off-road vehicle boasts a range...

Investment, Trade & Industrialization Cabinet Secretary Rebecca Miano has vowed that the government will continue raiding all shops selling ant counterfeit goods warning that all those...

According to a new report by Boston Consulting Group (BCG) entitled The Whole Truth about Whole Grains, there is huge opportunity in food system transformation, but...

ALN Kenya and ALN Tanzania (the Firms) and Adili Group are pleased to announce the appointment of Chris Diaz as Executive Chairman of Adili Group andDirector...

Dr. Hon. Esther Muchemi, the Founder, Managing Director, and Chief Executive Officer of the esteemed Samchi Group of Companies, has taken a moment to shed light...

East African Breweries Limited (EABL) announces the 9th edition of the World Class Kenya 2024 Bartending Competition, presented by DiaGeo. The competition runs worldwide with more...

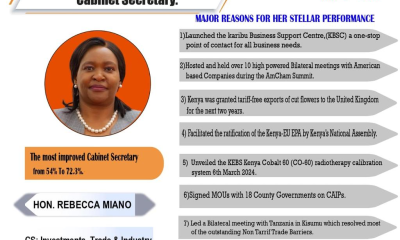

Trade and Investment Cabinet Secretary Rebecca Miano has been ranked as the best-performing CS in a recent survey by Mizani Africa. Miano got a 73.2 per...